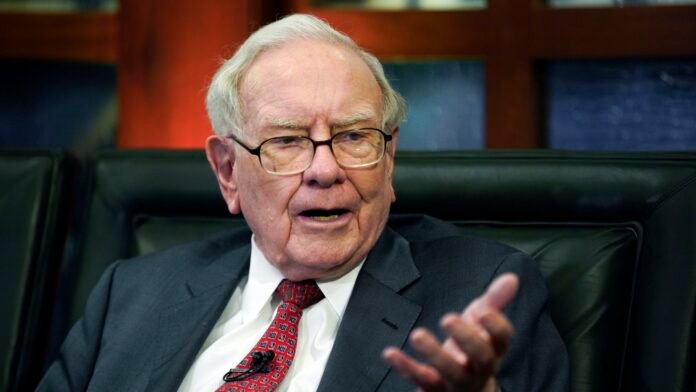

Warren Buffett, the Oracle of Omaha, and his company Berkshire Hathaway have built a reputation for navigating market downturns successfully. During the recent market sell-off triggered by President Donald Trump’s tariffs and global trade tensions, Buffett’s strategy stood out. Unlike many investors, Buffett stayed on the sidelines, stockpiling cash and purchasing few stocks. Berkshire Hathaway also repurchased fewer shares than in previous years.

As of April 22, with the broader S&P 500 down about 10%, the key question remains: When will Buffett turn bullish? Investors typically learn about large funds like Berkshire Hathaway’s stock picks only once every 90 days. Large funds are required to disclose stock holdings within 45 days of the end of each quarter. Since the first quarter ended on March 31, Berkshire Hathaway won’t need to file until around May 15.

Sometimes, if a fund acquires a significant position in a stock, they need to file immediately. Berkshire owns large shares in many of its holdings because its portfolio is so vast. For instance, Berkshire controls nearly 44% of DaVita, over 35% of Sirius XM, and more than 28% of Occidental Petroleum.

As of now, Berkshire has not filed any documents indicating major new stock purchases or increased positions in companies. That doesn’t mean Berkshire isn’t buying; it simply shows Buffett and his team remain disciplined. They will only invest in “wonderful companies trading at fair prices.”

Before the tariff-induced market meltdown this month, the market had been consistently rising for about 2.5 years. Despite the recent sell-off, there’s no clear indication that the market is undervalued yet.

Buffett often uses the Buffett indicator to assess market value. This indicator compares the market cap of the Wilshire 5000, a benchmark for U.S. stocks, with the U.S. GDP. Though the Buffett indicator hasn’t been below 100% since 2013, it still looks expensive at 176%, down from all-time highs above 200%. Additionally, the Shiller CAPE ratio, which compares the S&P 500’s market cap to its 10-year average inflation-adjusted earnings, is currently around 33. While this is close to its five-year average, it still exceeds the 10-year average.

Until these indicators show better value, Buffett will likely remain cautious and wait for the right market conditions. Investors are eager to see if and when Buffett decides to go bullish again.

In conclusion, Warren Buffett’s cautious approach in light of the market’s volatility reflects his strategy of staying disciplined. As the market shows signs of uncertainty, many are wondering when Buffett will turn bullish again. The question remains: Will Buffett’s cautious stance give way to optimism as the market adjusts?

For more updates, visit DC Brief.