Goldman Sachs economists have issued a stark warning about the dangers of political interference in central bank policy. Their latest report shows that weakening the independence of institutions like the Federal Reserve could trigger serious economic consequences.

The team, led by Jan Hatzius, found that reduced autonomy for central banks often leads to higher inflation. It can also push down stock prices and weaken national currencies. The findings reinforce the long-standing view that politically independent central banks are better positioned to maintain economic stability.

The report draws on global studies and historical cases. It emphasizes that central banks function best when they can act without political pressure. Independence allows them to balance inflation control with steady economic growth.

Public criticism from political figures poses one of the biggest threats. The report notes that ongoing attacks on the Federal Reserve could erode public trust in U.S. monetary policy. Legal moves to remove Fed officials or change their roles further undermine the institution’s strength.

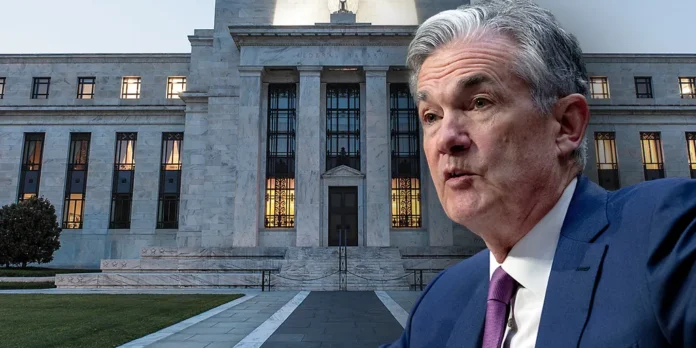

The warning comes as President Donald Trump continues his criticism of Fed Chair Jerome Powell. Trump previously urged the central bank to lower interest rates. At one point, he even threatened to remove Powell, though he has since backed off.

Despite questions about whether a president can legally fire a Fed chair, the tension has raised concerns about the future of monetary policy. Goldman Sachs highlights that even perceived threats to independence can hurt credibility and investor confidence.

Goldman Sachs warns undermining central bank independence risks inflation and long-term economic instability. Without firm safeguards, political pressure could disrupt markets and weaken recovery prospects.

For more updates, visit DC Brief.