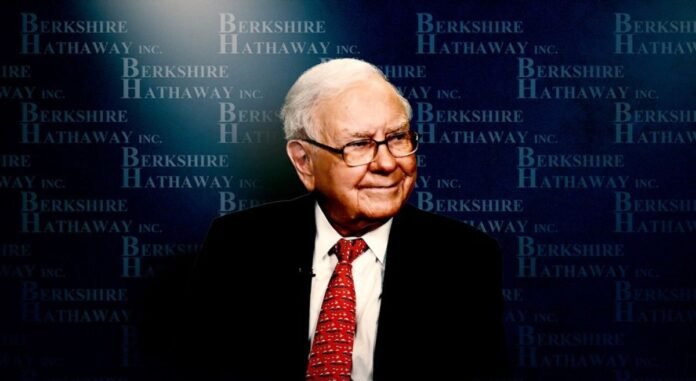

Berkshire Hathaway, the U.S. conglomerate led by Warren Buffett, reported a major profit drop due to a Kraft Heinz writedown. The company marked a decrease of over 50 percent in its quarterly earnings. This came after Berkshire slashed the value of its Kraft Heinz stake by $3.76 billion.

Although total profits fell, operating earnings stayed steady. Berkshire reported $11.16 billion in operating income, down slightly from last year. Strong performance from insurance, railroad, and utility businesses softened the impact. However, the profit drop linked to Kraft Heinz weighed heavily on results.

Kraft Heinz has struggled with declining brand value and changing consumer preferences. The rise in health-conscious trends hurt its processed food sales. Berkshire once viewed the company as a stable investment. Now, it considers Kraft Heinz a long-term challenge.

Berkshire owns over 27 percent of Kraft Heinz. Recently, the company stepped away from its board. This move came before Kraft Heinz began reviewing strategic changes. The food giant is now exploring options to spin off non-core brands.

Despite the profit drop, Berkshire still holds $344.1 billion in cash. Warren Buffett remains cautious, avoiding overpriced acquisitions. He told shareholders he hasn’t found deals worth pursuing. As a result, Berkshire made no major purchases last quarter.

During the annual meeting, Buffett revealed his plan to retire as CEO. Vice Chairman Greg Abel will take over operations. However, Buffett will stay on as Chairman. Investors noted Berkshire did not repurchase shares this quarter, even with falling stock prices.

Berkshire’s railroad unit, BNSF, performed well despite market uncertainty. It increased shipments and reduced expenses. As a result, BNSF achieved a 19 percent rise in operating profit. Meanwhile, rival Union Pacific plans a major merger, sparking industry speculation.

Still, Buffett prefers patience over market pressure. Analysts say he only acts when valuations align with Berkshire’s model. That discipline explains the company’s large cash reserves. He focuses on finding undervalued companies with long-term growth potential.

The profit drop caused by Kraft Heinz has not shaken Berkshire’s core stability. Its steady income and conservative investment approach continue to support resilience. Analysts believe the firm remains well-positioned for future opportunities.

For more business updates, visit DC Brief.