Treasury Secretary Scott Bessent has recently promised that American taxpayers will receive large tax refunds early next year. He specifically attributes this anticipated financial boost to recent legislative changes under a new act. The One Big Beautiful Bill Act includes several important retroactive tax provisions for this year. Because the bill passed in July after many people had already set their withholding, many overpaid.

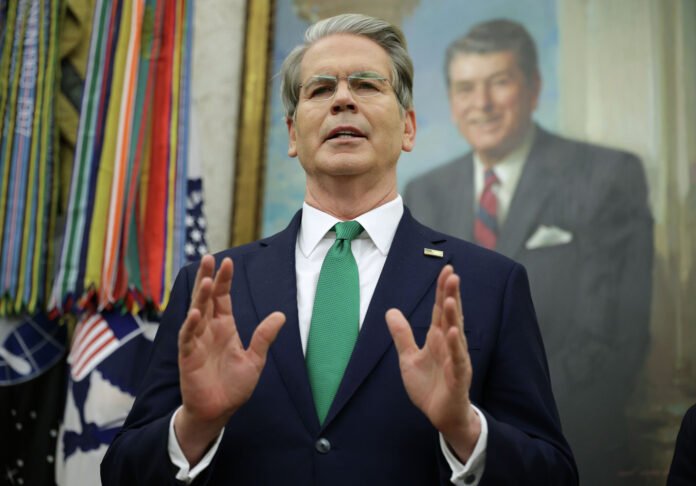

Consequently, Bessent projects a massive total of one hundred to one hundred fifty billion dollars in refunds. This substantial sum could mean an extra one thousand to two thousand dollars per household. These large tax refunds are expected to arrive during the first quarter of the upcoming tax filing season. Secretary Bessent made these comments during a recent television interview in Philadelphia.

He was promoting the current administration’s broader economic policies and their tangible benefits. The refund surge will provide immediate relief before workers adjust their payroll withholding amounts. After that adjustment, employees should then see a noticeable increase in their regular take-home pay. This two-step process could make the coming year a very good one financially for many families.

The administration is heavily emphasizing affordability and tax relief as key economic achievements. President Trump has also publicly promised the largest tax refund season ever for Americans. The recent legislation did much more than just create these new retroactive benefits for taxpayers. It also wisely extended the lower tax rates from the 2017 tax cuts that were expiring. Furthermore, it preserved the higher standard deduction that many households have come to rely upon.

These combined actions successfully prevented a significant tax increase that was looming for next year. The promise of large tax refunds arrives amid ongoing public concern about high costs for essentials. Recent opinion polling shows a strong majority remain worried about grocery and housing prices. A sizable refund can help families manage these persistent budgetary pressures and shore up finances.

Data from the most recent tax filing season provides some context for these new projections. The Internal Revenue Service issued over three hundred billion dollars in refunds by last October. The average refund amount for that period was just over three thousand dollars per return. Therefore, the new projections suggest a significant potential increase over those previous figures. The administration clearly hopes these refunds will improve the public’s economic outlook and confidence.