AI bubble risk surged into the spotlight this week as investors and executives clashed over the future of artificial intelligence spending. The debate intensified because the AI bubble risk now shapes how companies plan their next decade of investments. The conversation also grew louder as tech leaders defended their strategies while economists urged more caution.

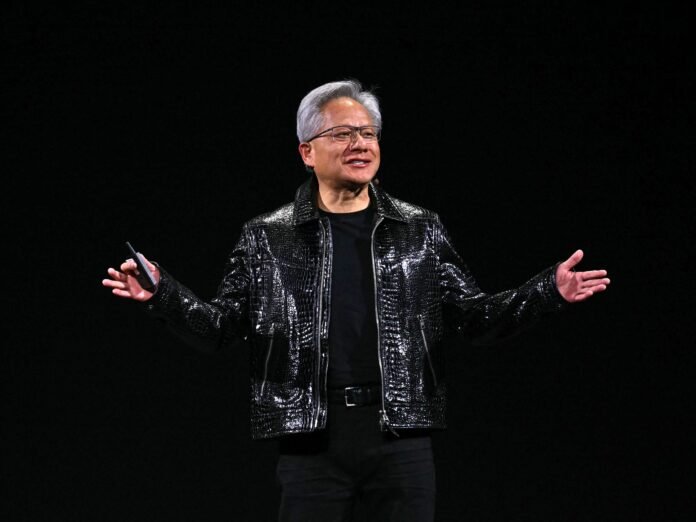

Nvidia CEO Jensen Huang pushed back against fears during a recent earnings call. He told investors that AI adoption still expands quickly and that concerns about overheating markets miss key facts. Many influential tech figures echoed similar views and insisted that the industry sits in a long-term growth cycle.

Yet analysts at major research institutions offered a different message. They argued that the hype around AI continues to exceed real-world usage. They also noted that AI bubble risk has grown because capital now pours into projects with uncertain payoffs. MIT researchers pointed to slowing model improvements and rising speculation across the industry.

Major companies continue to spend astonishing amounts on AI infrastructure. Executives at leading firms mapped out plans for new data centers that require long-term financial commitments. OpenAI’s leadership highlighted ambitious goals that rely on future demand for advanced AI services. However, economists warned that most users still avoid paid AI tools, which raises questions about long-term revenue.

Tech giants like Amazon, Google, Meta, and Microsoft plan to allocate hundreds of billions of dollars to computing expansion. Many firms used debt to support this expansion, and some turned to complex financing structures. Analysts explained that these arrangements help companies increase capacity while keeping debt off their balance sheets. However, they also noted that these moves add risk if demand slows.

Investors watched these developments carefully. Some high-profile figures sold major chip-related holdings and warned about possible market corrections. Hedge fund leaders said the sector relies too heavily on circular financial arrangements that inflate demand. They also pointed to historical examples where similar patterns triggered major downturns.

Industry veterans compared the current AI rush to the dot-com era. They said the sector risks building more capacity than the market needs. They also warned that heavy borrowing could stress financial institutions if AI revenue growth slows.

Meanwhile, top executives acknowledged the complexity of the moment. Leaders at several major tech firms admitted that excitement sometimes pushes investors toward unrealistic expectations. They stressed that AI will transform the economy but urged a clearer understanding of true demand.

Experts agreed that the sector needs stronger discipline. They emphasized that companies must track real productivity gains rather than rely on bold projections. They also said regulators and investors should monitor how debt shapes AI development.

Despite the uncertainty, the industry still moves forward. Companies continue to invest in new chips, data centers, and software. Developers and researchers expect AI to drive innovation, though they urge more realistic planning.

For now, the AI bubble risk remains a central topic for executives, economists, and investors. The sector stands at a critical point as spending accelerates, competition intensifies, and expectations surge.

For more business updates, visit DC Brief.